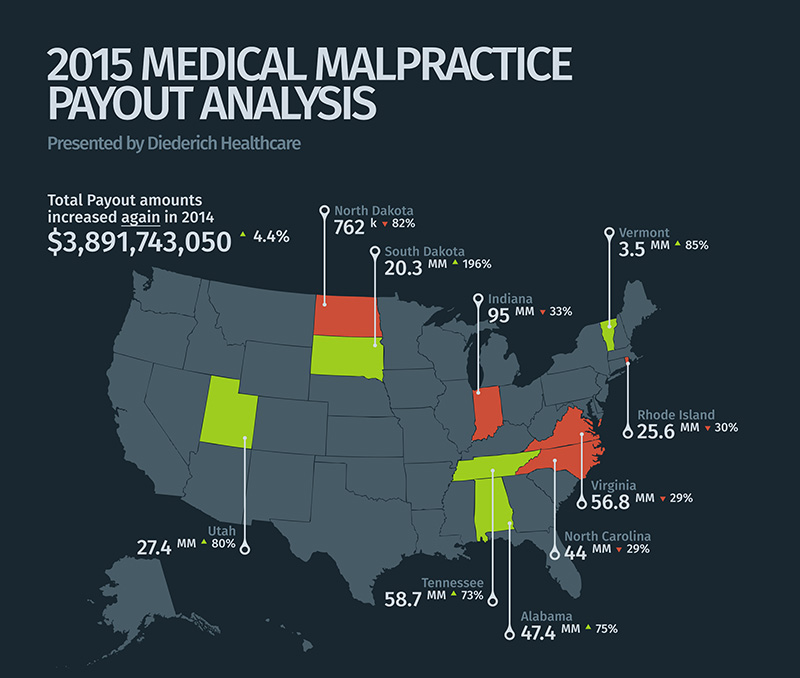

For the second consecutive year, medical malpractice payouts increased over 4% from the previous year. After seeing a steady decline in medical malpractice payout amounts from 2003 through 2012, malpractice payouts started to rise in 2013 and continued to rise at a steady pace in 2014 – marking a trend of increased medical malpractice payouts in the United States. The National Practitioner Data Bank (NPDB) data in 2014 saw an increase of 4.4% in total…

As a service to our clients and all physicians nation-wide, Diederich Healthcare has done an analysis of the medical malpractice payouts in 2014 as recorded by the National Practitioner Data Bank. Taking the data from the NPDB’s records, statistics were selected that will be both interesting and timely to doctors and all other medical professionals. 2014 marked the second consecutive year that malpractice payout amounts rose, creating a trend of increasing payout amounts. Diederich Healthcare…

Most physicians are aware of the importance of obtaining high-quality, comprehensive medical liability insurance. Although most states have basic minimum liability coverage requirements, some doctors do not understand the reasons that proper, individualized coverage is essential and how inadequate or sub-par policies can actually harm the physician, his or her practice, and tarnish professional reputations within the community. In this article, we will examine differences between professional liability policy forms to better help physicians formulate…

Most physicians will agree that their livelihood depends on the success of their practice. Although professional liability insurance will protect the insured from errors and omissions in their day to day patient contact, there are additional insurance options that will also protect against loss from many other unforeseen acts that can be devastating to both the physician’s practice and their reputation. For a healthcare provider, understanding the differences between coverages, knowing what is needed for…

When physicians are faced with shopping a current professional liability policy or purchasing a new policy, they will be presented options from many different types of carriers that each has advantages and disadvantages. Often, the needs of the physician and his or her practice will lend itself to a specific type of insurance carrier. In this article, we will provide insight into the different kinds of companies and what they can offer to the healthcare…

Depending on your current professional liability coverage program, your options for reducing your 2015 premiums could be limited. If you are one of the thousands of physicians in this situation, you may be liable for next year’s entire annual assessment unless you take action now. In some cases, you must give notice by October 31st that you intend to opt out of the 2015 assessment even though your coverage does not renew until December 31st….

The majority of professional liability insurance policies today are written on a claims-made basis. That means you, the physician, are protected by the insurance company providing coverage at the time the claim is made against you. The other, less common form is an occurrence policy. This means you, the physician, are protected by the insurance company providing coverage at the time the incident occurs, regardless of when the claim is made. While these are the…

The primary reason for purchasing malpractice insurance is to protect yourself from a financial loss in the event of a claim being filed against you. Therefore, your number one concern should be whether or not an insurance company is capable of properly defending you. Questions to ask your broker about potential insurance carriers are: Is the carrier financially sound? You can obtain NAIC reports from your broker to review each carrier’s financials from the previous…

Perhaps you received a letter in the mail offering you cheaper coverage than what you currently have, but you are in the middle of your current policy period. Or maybe you just renewed with your current company and feel you may be stuck with that policy, even if you have found a better rate. Physicians and practice managers often have questions regarding switching their coverage mid-policy period. There are typically several questions and concerns that…

With the number of Physician Assistants projected to grow 39% by the 2018, the need for individual Physician Assistant malpractice insurance coverage is growing exponentially as well. While it is true that the supervising physician is responsible for the actions of their Physician Assistant, this does not absolve the Physician Assistant of individual liability should a malpractice claim arise. In fact, when there is a medical malpractice settlement or judgment, the average indemnity payment for…

Recent Comments